There has been a recent spike in the development of mobile operating systems leading to releases of Firefox OS, Ubuntu for Phones and Jolla Sailfish. Exotic-sounding for sure, but there's one name missing from the list, a mobile-optimized OS that will begin appearing in mass-produced handsets in mid-2013. Tizen is its name, and its developers intend it to power a variety of devices including phones, tablets, vehicles and televisions.

Tizen is a fresh new project, but it has roots in several pre-existing platforms including the distributions Moblin, MeeGo and LiMo. According to the Tizen Association, “The mobile marketplace has undergone extensive change over the past few years. New platforms have emerged, new revenue models have been enabled, and innovations continue to emerge rapidly from all corners of the industry. Tizen is an open-source solution that provides an innovative platform offering a high level of flexibility in service selection and deployment.”

Tizen's roots and rich history bring a number of groups together and give rise to a management problem. To leverage the competence of the groups involved, Tizen is managed by the following:

The Linux Foundation: according to the official documentation, the Tizen project “resides” within the Linux Foundation and is governed by a Technical Steering Group.

The Technical Steering Group: the Technical Steering Group is the primary decision-making body for Tizen, with a focus on platform development and delivery, along with the formation of working groups to support device verticals.

The Tizen Association: the Tizen Association has been formed to guide the industry role of Tizen, including gathering of requirements, identification and facilitation of service models, and overall industry marketing and education. In the Tizen Association's own words, “The Tizen Association's charter is to actively develop the ecosystem around Tizen, which includes the market presence, gathering of requirements, identification and facilitation of service models, and overall industry marketing and education.”

Corporate Supporters: the two corporations providing the longest-running support for Tizen are Intel and Samsung. Other manufacturers include NEC, Panasonic, Fujitsu and Huawei. Several telecommunications operator corporations supporting Tizen market adoption include Orange, NTT Docomo, SK Telecom, KT, the Vodafone group, Telefonica and Sprint. Finally, Jaguar Land Rover heads up the automotive market in adopting Tizen for its IVI infrastructure.

Huawei Onboard: according to analyst David Kerr, VP of Global Wireless Practice at Strategy Analytics, “The addition of Huawei is a significant step forward adding one of the fastest-growing handset vendors in the world and reinforcing the potential for an alternative to Android to develop in both mature and emerging markets for smart devices. The decision by Huawei to support Tizen follows hot on the heels of several other announcements, all of which put pressure primarily on the Android OS and clearly demonstrate that most major vendors and indeed operators continue to hedge their bets as uncertainty and concerns over Google's dominance continue.” Sadly, early adopters of Tizen technology have felt little Huawei presence or support so far, the company being suspiciously absent from the recent Tizen developer conference although advertisements stated Huawei sponsorship. According to one industry insider, the company had planned a conference appearance but backed out of the arrangement, leaving one to hope that other relatively passive players like Fujitsu, Panasonic or NEC are not sitting on the sidelines for lack of optimism.

Intel has enjoyed a partnership with Google's Motorola unit, which would seemingly put any future strategic focus on Tizen at odds with Samsung's potential distancing of Android. Additionally, Intel considers Android and Windows to be complimentary technologies. It follows that Intel's market view of Tizen will be similar in the sense that even as Tizen winds up competing with Android for market share, Intel will profit nicely, supporting both platforms with specialized chips and drivers.

In any case, having Intel on board as a Tizen partner will please open-source enthusiasts and Linux users alike. Being the number one commercial contributor to the Linux kernel, “Intel gets the bigger picture of open-source value”, says Kaveh Nasri of the Open Source Technology Center. “When you do (open source), the consumer benefits.”

Mr Nasri's group at the Open Source Technology Center is busy developing drivers for the next generation of Intel chips that could soon be powering a Tizen device coming to market, even as Intel competes with several other strong mobile semiconductor manufacturers like ARM, NVIDIA and Qualcomm, he reports. Tizen engineers build development images for both IA32 and ARM architectures on a regular basis, and while the scarcely distributed Intel Black Bay handset housed an IA32 Atom processor, the majority of existing Tizen-powered experimental devices like the Samsung RD-210 and Samsung RD-PQ pack ARM processors.

When asked about Tizen's chances as far as competing with established trend-setters like Android and iOS, midterm arrivals like Blackberry 10 and Windows Phone, or emerging contenders like Firefox OS, Ubuntu Touch or Sailfish, Mr Nasri says that Intel's commercial interests are OS-agnostic. “We just want to sell our silicon”, he indicates of Intel's chips and supporting drivers. Linux Foundation Operations Manager Brian Warner provides a different perspective, stating that “Linux collectively does better” when more Linux-based platforms compete. “There is a real opportunity here, and we want to see them all succeed.”

Such statements are loaded with a rich history of ups and downs at Intel and the Linux Foundation along with associated technologies. Intel is the founder of Moblin and along with the Linux Foundation was a strong supporting partner of MeeGo, the mobile-optimized predecessors to Tizen. Many would have preferred these technologies to thrive, but their short-lived experimental nature leads some to question Tizen's viability, especially after unraveling corporate partnerships accelerated MeeGo's fall.

Mr Nasri reflects on his 24-year tenure at Intel and remarks, “There's all sorts of alliances and agreements” between Intel and its partners. In the present case, aside from the Linux Foundation, the two key corporate players supporting Tizen are Intel and Samsung. While Samsung likely has its own bet-hedging mobile strategy, Samsung executive VP Jong-Deok Choi gives assurance of full Tizen support in explaining that “Tizen and Android will get along very well.”

But a cynical perspective of Tizen's market chances based on Moblin and Atom chips is hard to apply considering Intel's success in the processor races with PowerPC and AMD. Savvy mobile computing enthusiasts may appreciate Intel's long-term contributions to a vibrant open-source ecosystem and protection of computing freedom by supporting community projects like Cordova and Connman. When asked about his alleged opposition to a nearly decided walled-garden deployment approach, chief architect of the Intel Open Source Technology Center Sunil Saxena humbly smiles. His expression as speaking history implies a profound understanding that Tizen's chances of success lie on a solid but open technology foundation.

Mr Nasri agrees that Tizen can beat the odds in contrast to Moblin, MeeGo and even Symbian or Bada. He brings up the important topic of intrusive legal bureaucracy, such as intellectual property constraints typical at large corporations. Open source allows us to do an “end run around the non-disclosure agreement (NDA) lawyers”, he states.

Just one problem exists with the open-source approach taken by Tizen. Original Tizen source code (as opposed to integrated components) is licensed under terms of the Flora license, which is not approved by the Open Source Initiative (OSI). In theory, this failure to obtain OSI's blessing places Tizen somewhere in between proprietary and open-source platforms. In practice, this choice could affect a number of interested parties. Assuming that many would otherwise use Tizen for its added development and operating freedom, the choice of a Flora license is unfortunate and may cloud management's ability to judge Tizen's legal viability in their markets.

An industry insider familiar with intellectual property (IP) law states, “likely at this stage our only real allies are the open dev crowd, those who like Tizen because it is open and a real Linux.” The insider claims that, “Firefox OS dev phones sold out almost instantly” for just this reason.

Nevertheless, cracks may be appearing in Tizen's developer tech armor due to decisions relating to overreach of a scheduled Bada migration. An industry insider refuses cooperation in this area, saying instead “I am not going to be the guy who is asked why is Bada used now instead of EFL?”, clearly fearing that Tizen's pristine and future-proof architecture may be infected with legacy Bada logic.

High-ranking corporate policy-makers happily state their optimism of the approaching Tizen smartphone market entry. Samsung executive VP Jong-Deok Choi expresses his assurance that, “We have very high expectations”, and “Tizen is very real.” But what strategy is behind the policy of strong industrial support for Tizen's rollout? To understand the various corporate strategies involved in shaping Tizen's future, as well as obtaining a realistic interpretation of Tizen's environmental market trends, informed opinions by diverse analysts give added value.

We ask if Samsung could be using Tizen as a hedge against Android's ever-growing market dominance, leading OEMs and chip-makers to play cat and mouse in adapting to the fragmented and controlling Android platform. Analysts do speculate along these lines that since Google acquired Motorola Mobility, Samsung and other smartphone manufacturers would be seeking alternatives to Google's Android. Android could become the preferred platform for Motorola, which likely would put competing manufacturers at a disadvantage.

Gartner's latest figures put Android's market share at nearly 75% of world-wide smartphone adoption. “With new OSes coming to market, such as Tizen, Firefox and Jolla, we expect some market share to be eroded but not enough to question Android's volume leadership”, states Gartner principal research analyst Anshul Gupta.

Indeed, as Android adoption has shot sky-high, a number of new mobile platform contenders have lined up to compete. IDC mobile-phone research manager Ramon Llamas and IDC worldwide quarterly mobile-phone tracker senior research analyst Kevin Restivo remark that “This is shaping up to be a pivotal year for the open-source operating system, as multiple platforms, including Mozilla, SailFish, Tizen and Ubuntu are expected to introduce or launch their first smartphones in the coming months.”

Strategy Analytics analyst Scott Bicheno continues, “Android will remain the dominant smartphone OS for the next few years, but its share will peak in 2013, while the global share of iOS is unlikely to grow much further so long as Apple maintains its premium-tier-only strategy. While Microsoft's market share will remain small in 2013, it will emerge as the clear third-placed platform by 2017, with BlackBerry leading a chasing pack that will include the nascent smartphone platforms: Tizen, Firefox OS, Ubuntu and Sailfish.”

But while Samsung has profited nicely from its widespread Android integrations, some analysts have criticized it for failing to innovate. Using Google's software is leading to a risky dependence on the software giant's technology even after its strategic acquisition of Motorola's mobile division, a direct competitor to Samsung. They reason that Tizen enjoys additional support due to these market developments. “Samsung has grown up and is playing as the big guy, moving away from Android”, says Gartner Mobile Devices Research VP analyst Carolina Milanesi.

Kevin Burden, an analyst at Strategy Analytics, agrees that Samsung is motivated to distance itself from Android for this reason but also partly because it wants greater control over the operating system in its phones. “It almost feels like Samsung is trying to set up Tizen as its next OS instead of Android”, he says.

Vice President of Yandex Labs Juggs Ravalia puts forth the theory that many corporate heavyweights (especially operators) in the Tizen Association are worried about lock down in Android APIs and want to free their technology from difficulties circumventing Google-dictated services like Maps. While standing to benefit strategically from both added development freedom and a Tizen success, operators like NTT Docomo have confirmed that Tizen is a very operator-friendly platform.

This bodes well for the multinational operator Orange. According to Frédéric Dufal, Technical Director of Orange Devices and Vice Chairperson of the Tizen Association, the launch of Orange's first Tizen device will occur in select European markets at the end of summer 2013 with more devices coming at later launch dates.

But Orange is not just interested in the traditional smartphone markets, rather “I hope Tizen someday will be delivering great stuff for emerging markets and especially Africa, and Orange is very active there”, says Mr Dufal.

In fact, although Orange and France Telecom have strong commercial representation in many African countries due to historical French trade relations, they share a second commercial interest in meeting demand for less-expensive smartphone technology served by competing multinational operators like Telefonica with their Firefox OS handsets. Should either or both such efforts succeed, then mobile users in emerging markets win in the end, but what does this mean for Tizen? Mr Dufal answers, “We hope that in the longer term, we can use Tizen to democratize the access to the Internet and to smartphones in emerging markets especially in Africa and the Middle East, where not everybody can afford the fancy smartphones.” His words could resonate with users in expense-reduced hardware markets producing the likes of OLPCs and Raspberry Pis.

Internet companies like Yandex are turning to Tizen for its help in solving problems with and improving cutting-edge developments like navigation, assisted transportation searches and in vehicle infotainment (IVI.) According to Vice President of Yandex Labs Juggs Ravalia, Tizen could serve as a platform for a new generation of services only possible through the innovative combination of big data and free software APIs like those provided by Tizen.

It's no surprise that Yandex is working on transportation-relevant network services. According to Senior Technical Specialist for infotainment systems at Jaguar Land Rover Matt Jones, “uptake of HTML5 in vehicles is going through the roof”, and that “Linux is running in over a million vehicles already.” Mr Jones goes on to state the utility and consumer thirst for rich IVI systems, for which Tizen is a perfect platform match.

Everybody knows that smartphone consumers are enchanted by platforms stocked with eye-catching games. A number of companies providing game platforms, engines and more than a dozen game technologies have come forward to meet Tizen's game needs, including big names like Havok, Unity 3D, Yoyo Games, Marmalade and Gamesalad. Tizen's potential as a game platform is attracting independent developers of HTML5 technology as well, with companies like Sencha Touch providing JavaScript abstraction libraries for accelerated development.

Speaking on behalf of one of the largest game engines, Unity General Manager John Goodale emphasizes ubiquity when speaking of a giant mobile market large enough to accommodate a number of new technologies. The smartphone market supports an “explosive industry that is growing very rapidly”, states Mr Goodale. “There's not just room for two or three or a handful of players”, rather “the market can extend to as far as we can effectively execute”, he says. Regarding the ubiquitous nature of mobile technology creeping into our lives over time, Mr Goodale continues, “some things have become so commonplace that we hardly notice them”, and that according to Juniper Research, mobile devices like Tizen smartphones likely will be the primary hardware for gaming by 2016.

Figure 5. Some things are so commonplace that we hardly notice them. (GNU Free Documentation License 1.3)

Referring to Unity's decision to support Tizen (as well as Tizen's entry in the smartphone market) Mr Goodale summarizes, “Jump on in, the water's warm.”

A number of technical characteristics set Tizen apart from other systems with similar mobile-oriented goals. Aside from any number of eye-candy features likely to be implemented close to a first device launch date, Tizen designers will need to strive for unique features to secure technical distinction that sets Tizen apart from its competition. Consumers interested in such unique technology include a number of actors along the technical “food chain” starting with designers to programmers and finally end users.

For Linux users, first and foremost is the familiar layout of Tizen's internal filesystem. Most configuration can be found in /etc, runtime variable state in /var, user files in /home/<user>, temporary files in /tmp and so on. While security abstraction measures exist to mark and protect certain regions (SMACK), this filesystem familiarity will surely provide comfort to some.

Tizen puts forth the concept of dynamic boxes, small Web applications embedded inside other applications, to provide users with dynamically updated content. The rich Tizen API exposed to provide dynamic box logic supports the dynamic box with an independent life cycle. At runtime, Tizen's Web runtime has the ability to control the life cycle of dynamic boxes.

Compared with nearly all existing mobile platforms, Tizen offers an unrivaled degree of end-user freedom. A user can modify or replace any part of the platform right down to the kernel and low-level security layers. Rather than blurring the lines of free license by releasing binary blobs of kernel and libc while publishing only sanitizing header files, Tizen's GNU/Linux kernel and other sources are complete, on-line and publicly accessible. Developers can pull a copy of these sources and build their own Tizen image ready for installation to hardware. It remains to be seen if operators will implement tricky bootloaders to lock terminals to custom kernels and certain Tizen drivers depending on proprietary microcode (like the modem providing cellular voice communication), but as far as platforms go, Tizen provides the end user with far-reaching freedoms.

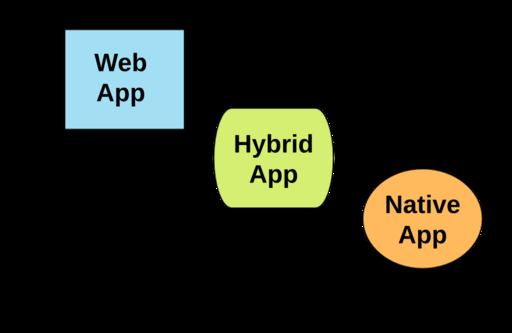

Arguably, from a development perspective, Tizen's unique platform architecture sets it apart from nearly all competitors with the exception of Blackberry. Tizen's architects eyed a variety of device types from the beginning, leading to a flexible architecture that will accommodate all sorts of tablets, desktops, vehicle terminals (IVI), television consoles and others once the first wave of smartphone handsets is rolled out. Furthermore, Tizen's layered architecture features core components and frameworks providing APIs to high-level applications of a variety of technologies. This breadth of logic will appeal to developers of Web, native, hybrid and third-party technologies alike.

Scoring 492 of 500 points at html5test.com, “Tizen support for HTML5 is the best among mobile browsers”, says Samsung executive VP Jong-Deok Choi. Speaking of its Web runtime and Web framework support, “Tizen is the platform most compliant with HTML5 standards”, agrees Mr Dufal. It's also important to note that security features like content security policy (CSP) are built in to Tizen's Web runtime as well.

Regarding the question of how high Tizen will rise by leveraging Web technologies, W3C mobile Web initiative activity lead Dominique Hazael-Massieux replies, “Tizen is very well positioned for sure.”

Developers accustomed to POSIX server technology can port their existing IA32 server software quickly and easily using the tools freely available in the Tizen SDK (supporting Linux, OS X and Win32 OS types). Packaging the ported software to RPM files and installing to the device is straightforward. Other developers of client apps can choose from Web or native frameworks and deploy from the Tizen Store in the usual way.

Figure 8. Tizen supports a broad range of technologies in mobile apps (GNU Free Documentation License 1.3).

Tizen includes logic to run native (often server) code alongside Web (often client) code packaged together, providing a convenient transport for complex applications requiring device-specific features (for example, an SSL crypto library) as well as a high-level UI (for example, Web-based for ease of maintenance).

Finally, third-party providers of system abstraction frameworks like Adobe Phonegap, Apache Cordova and Appcelerator Titanium serve to fill any technical API gaps and facilitate porting of existing applications even further.

It remains to be seen how enthusiastic a less tech-savvy user will be about such distinctive technical features, but such users may indirectly profit from quick porting of outstanding applications in other mobile OS distributions. They could benefit additionally from high-powered compiled applications running on Tizen's native APIs when such an architecture is relevant. This model appears to match Research in Motion's efforts with its Blackberry 10 release; however, closer inspection reveals nuances in handling of Web applications by the respective Web runtimes as well as obvious differences in graphics widget toolkits and POSIX implementations.

According to the Tizen Association, “As part of the Tizen Association's focus on ecosystem development, the Tizen Store will launch later in 2013 with thousands of apps, allowing developers to monetize their work and creating a robust ecosystem. The outreach to app developers to build HTML5 apps has begun.”

It remains to be seen how favorably developers will take to Tizen's store or how enthusiastically consumers will use it. Although Director of Systems Engineering Mark Skarpness emphasizes that “The Tizen App Store is open for business”, neither APIs nor client applications have been revealed. Nevertheless, developers already are free to open accounts and submit applications for no charge. Even better, sponsors with deep pockets have announced official Tizen developer contests awarding impressive prizes. According to the Tizen Association's planned Tizen App Challenge, “With over $4M in cash prizes, there's never been a better time to create or port that awesome app for Tizen.”

Aside from improvements stemming from upcoming events and contests to attract application developers, the store is currently under administration by Samsung, who will likely change legal conditions and add distribution jurisdictions in the coming weeks.

Other relevant yet unanswered technical questions include how the store will implement important validation features like static security analysis, if advanced machine learning will be employed, and just how human analysts will inspect and clear incoming submissions.

Finally, while Tizen supports application side loading (manual installation), a number of third-party distribution services go one step further. Projects like 5Apps, AppUp, NeXva, AppsFuel, HTML5 Ninja and BoosterMedia could prove useful in niche application distribution.

The chances for a successful Tizen smartphone entry depend on Tizen's ability to accommodate today's fast-moving technology trends, vigorous marketing of unique features to tech-thirsty users otherwise accustomed to offerings from the Android iOS duopoly in western markets, and finally, Tizen must fight head to head with upcoming contenders like Firefox OS and Ubuntu Touch to capture a share of less-expensive smartphone use in emerging markets.

While technology analysts are far from united in their opinions, some statements suggest a trend of reduced Android adoption, leaving market share up for grabs. In contrast to its past Android and Bada concentration, Samsung, being strongly positioned in the high-end smartphone handset market, likely will play an important role in corporate-sponsored Tizen developments.

Aside from corporate power, Tizen must mobilize organic growth, such as users migrating from Bada, others smitten by its distinctive technology, developers drawn by its attention to freedom and strong community support. These factors could tip the scales, taking Tizen past the threshold of critical mass and lead to further sales growth and mass adoption.